The Significance of Financial Freedom

Financial freedom is more than just a buzzword; it represents a state of being where individuals have sufficient personal wealth to live without having to work actively for basic necessities. In other words, it is a condition where money is not a source of stress but rather a tool for empowerment. Therefore, the significance of achieving this level of financial independence cannot be overstated. It allows individuals to make choices that enhance their quality of life, pursue passions, and secure a comfortable future.

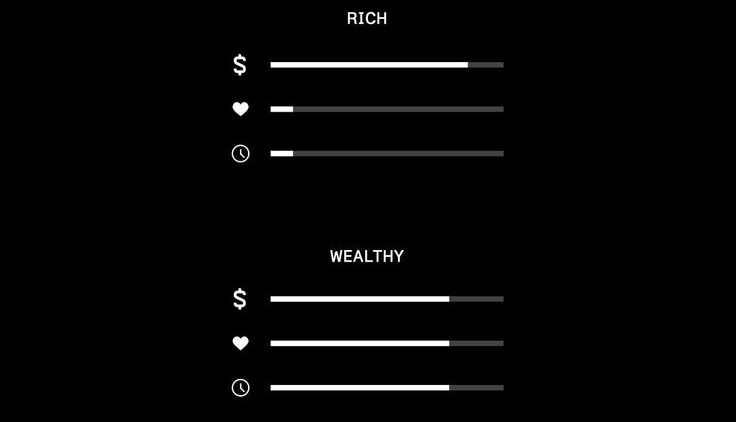

Understanding Wealth

At the core of financial freedom lies the concept of wealth. Wealth, however, is not merely the accumulation of assets; it encompasses a broader spectrum that includes financial literacy, investment acumen, and strategic planning. Thus, wealth creation involves understanding how to make your money work for you rather than you working for your money. This shift in mindset is crucial. Furthermore, it is essential to recognize that wealth is built over time through disciplined saving, prudent investing, and continuous education.

The Pillars of Financial Independence

Achieving financial independence requires a solid foundation built on several key principles. These pillars serve as a roadmap for anyone looking to unlock financial freedom and can help demystify the often complex world of finance.

Budgeting: The Cornerstone of Financial Management

First and foremost, budgeting is the initial step towards financial independence. It involves tracking your money and understanding where it goes each month. For example, by creating a budget, you can identify unnecessary expenditures, allocate funds towards savings, and ensure that you are living within your means. As a result, the process of budgeting empowers you to make informed decisions regarding your finances and helps you focus on building your wealth.

Saving: The Pathway to Wealth Accumulation

In addition to budgeting, saving is a fundamental principle in the journey towards financial freedom. It involves setting aside a portion of your income for future use. For instance, creating an emergency fund, saving for retirement, and building a general savings account are all essential components of a robust financial strategy. Consequently, the discipline of saving not only prepares you for unexpected expenses but also sets the groundwork for wealth accumulation. The more you save, the more you can invest, which leads to exponential growth in your wealth.

Investing: Making Your Money Work for You

Once you have established a solid saving strategy, the next step is investing. Investing is a powerful tool that can significantly accelerate your journey towards financial independence. Specifically, it involves putting your money into assets that have the potential to grow over time, such as stocks, real estate, and mutual funds. Therefore, understanding the various investment vehicles available to you and their respective risks and rewards is crucial. Moreover, the earlier you start investing, the more you can leverage the power of compound interest to build your wealth.

The Role of Education in Financial Independence

Financial literacy is a critical component of achieving financial independence. Understanding the fundamentals of money management, investment strategies, and economic principles will empower you to make informed decisions. Moreover, continuous education in finance is essential, as it equips you with the knowledge to navigate through the complexities of the financial world. For example, numerous resources are available, including books, online courses, and financial advisors, all of which can enhance your understanding and help you to make smarter financial choices.

Diversification: Reducing Risk for Sustainable Growth

Another important principle is diversification, which should not be overlooked in the pursuit of wealth. It involves spreading your investments across various asset classes to mitigate risk. By diversifying your portfolio, you can protect yourself from market volatility and ensure that your financial future is not solely dependent on the performance of a single investment. Consequently, this strategy allows for sustainable growth and helps maintain your money in the long run.

Setting Financial Goals: A Roadmap to Success

Setting clear and achievable financial goals is another essential principle in the journey towards financial independence. Goals provide direction and motivation, allowing you to focus your efforts on specific outcomes. For instance, whether it’s saving for a home, funding your children’s education, or planning for retirement, having defined objectives will help you to measure your progress and adjust your strategies as needed.

The Mindset of Wealth

Lastly, the mindset you adopt plays a significant role in your financial journey. Cultivating a positive and proactive attitude towards money can open doors to opportunities that lead to greater wealth and financial independence. Therefore, embrace a mindset of abundance rather than scarcity, and be open to learning from both successes and failures. Additionally, understanding that financial independence is a journey rather than a destination will help you stay committed to your goals.

Advanced Strategies for Financial Independence

Having established the foundational principles of financial independence, it is essential to delve deeper into advanced strategies that can further enhance your journey towards unlocking financial freedom. While budgeting, saving, investing, education, diversification, goal-setting, and the right mindset are critical, there are additional tactics that can help you optimize your financial strategy and accelerate your path to wealth accumulation.

Leveraging Debt Wisely

Debt is often viewed as a financial burden; however, when managed wisely, it can become a powerful tool for building wealth. Understanding the difference between good debt and bad debt is crucial. Good debt refers to borrowing that is used to acquire assets that have the potential to generate income or appreciate in value, such as real estate or education. Conversely, bad debt is often associated with high-interest loans and credit card debt used for consumption rather than investment.

Understanding Good Debt vs. Bad Debt

To leverage debt effectively, start by distinguishing between good and bad debt. Good debt can be seen as an investment in your future, while bad debt can hinder your financial growth. For instance, taking out a student loan to gain skills that will increase your earning potential can be considered good debt, while accumulating credit card debt for non-essential items would be classified as bad debt. By focusing on good debt, you can enhance your financial position while minimizing the risks associated with borrowing.

“To wrap things up, there’s a video at the end of this article that provides a clear and engaging explanation, making it easy to understand.”

Utilizing Credit Strategically

In addition to managing debt, credit can also be a valuable asset when used strategically. Building a good credit score enables you to access lower interest rates on loans, which can save you thousands of dollars over time. Additionally, it’s important to manage your credit card balances, make timely payments, and avoid unnecessary debt to maintain a healthy credit profile. Furthermore, consider leveraging credit for investment opportunities, such as financing a rental property that generates passive income.

Building Passive Income Streams

Another advanced strategy for achieving financial independence is to focus on building passive income streams. Passive income refers to earnings derived from investments or business ventures that require minimal effort to maintain. This allows you to generate income without actively working for it, which can significantly accelerate your journey to financial freedom.

Real Estate Investments

For example, investing in real estate is one of the most popular ways to create passive income. By purchasing rental properties, you can earn monthly rental income while the value of the property appreciates over time. Moreover, real estate can provide a hedge against inflation and is often considered a stable investment. However, it is crucial to conduct thorough research and understand the market before diving in.(It is not investment advice)

Dividend Stocks and Funds

Dividend stocks and funds are another avenue for generating passive income. By investing in companies that pay dividends, you can receive regular payments while also benefiting from potential price appreciation. Furthermore, look for stocks with a history of consistent dividend payments and consider reinvesting dividends to accelerate your wealth accumulation.(It is not investment advice)

Creating Digital Products

In the digital age, creating and selling digital products such as e-books, online courses, or software can provide a lucrative source of passive income. Once created, these products can be sold repeatedly with minimal ongoing effort. Therefore, focus on leveraging your expertise to develop products that provide value to others, and consider utilizing platforms that can help you reach a wider audience.

Networking and Building Relationships

Networking is often an overlooked aspect of financial independence, yet it plays a vital role in unlocking opportunities for growth. Building relationships with like-minded individuals, mentors, and industry professionals can provide invaluable insights and connections that can propel your financial journey.

Finding a Mentor

A mentor who has successfully navigated their financial journey can offer guidance and support as you pursue your goals. For instance, they can provide insights on investment strategies, career advancement, and wealth-building techniques. Therefore, seek out individuals who inspire you and have achieved the financial independence you aspire to reach.

Joining Financial Communities

Engaging with financial communities, whether online or in person, can provide support and accountability. These communities can offer valuable resources, educational content, and networking opportunities. Additionally, participating in discussions and sharing experiences can enhance your understanding of financial concepts and motivate you on your journey.

Continuous Improvement and Adaptability

Finally, embracing a mindset of continuous improvement and adaptability is essential for long-term financial success. The financial landscape is ever-changing, and staying informed about market trends, investment opportunities, and economic shifts is crucial.

Regularly Reviewing Financial Goals

Set aside time to regularly review and adjust your financial goals. Life circumstances and market conditions can change, and your financial strategy should evolve accordingly. By remaining flexible and open to changing your approach, you can better navigate challenges and seize new opportunities.

Investing in Personal Development

Investing in your personal development is just as important as investing in financial assets. Attend workshops, read books, and take courses that enhance your skills and knowledge. The more you learn, the better equipped you will be to make informed financial decisions and adapt to changing circumstances.

Your Financial Freedom Starts Now

Financial independence isn’t a distant dream—it’s a series of deliberate choices you make every day. By budgeting wisely, saving consistently, investing strategically, and building streams of passive income, you’re already laying the groundwork for a future filled with freedom and opportunity.

The path might seem challenging at times, but every step you take brings you closer to a life where money becomes a tool, not a source of stress. Start today—no matter how small the step—and watch as your efforts transform your financial reality.

Empower yourself, take control, and embrace the journey to financial freedom. The future you’re working towards starts with the decisions you make right now.

Leave a Reply